Contribution Margin: What It Is, How to Calculate It, and Why You Need It

In the Dobson Books Company example, the contribution margin for selling $200,000 worth of books was $120,000. On the other hand, net sales revenue refers to the total receipts from the sale of goods and services after deducting sales return and allowances. As you can see, the net profit has increased from $1.50 to $6.50 when the packets sold increased from 1000 to 2000.

How To Calculate?

At a contribution margin ratio of 80%, approximately $0.80 of each sales dollar generated by the sale of a Blue Jay Model is available to cover fixed expenses and contribute to profit. The contribution margin ratio for the birdbath implies that, for every $1 generated by the sale of a Blue Jay Model, they have $0.80 that contributes to fixed costs and profit. Thus, 20% of each sales dollar represents the variable cost of the item and 80% of the sales dollar is margin. Just as each product or service has its own contribution margin on a per unit basis, each has a unique contribution margin ratio.

Sales Revenue

- Before making any changes to your pricing or production processes, weigh the potential costs and benefits.

- Let us try to understand the concept with a contribution margin example.

- Using this metric, the company can interpret how one specific product or service affects the profit margin.

- Calculations with given assumptions follow in the Examples of Contribution Margin section.

- We’ll next calculate the contribution margin and CM ratio in each of the projected periods in the final step.

This is because it indicates the rate of profitability of your business. The gross sales revenue refers to the total amount your business how to convert myob to xero realizes from the sale of goods or services. That is it does not include any deductions like sales return and allowances.

Fixed Cost vs. Variable Cost

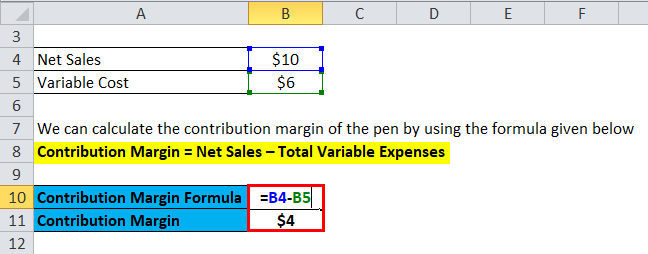

When only one product is being sold, the concept can also be used to estimate the number of units that must be sold so that a business as a whole can break even. For example, if a business has $10,000 of fixed costs and each unit sold generates a contribution margin of $5, the company must sell 2,000 units in order to break even. However, if there are many products with a variety of different contribution margins, this analysis can be quite difficult to perform. The contribution margin is a measurement through which we understand how much a company’s net sales will contribute to the fixed expenses and the net profit after covering the variable expenses. So, we deduct the total variable expenses from the net sales while calculating the contribution.

How is It Helpful to a Business?

The contribution margin is the foundation for break-even analysis used in the overall cost and sales price planning for products. Using this contribution margin format makes it easy to see the impact of changing sales volume on operating income. Fixed costs remained unchanged; however, as more units are produced and sold, more of the per-unit sales price is available to contribute to the company’s net income.

Contribution Margin: What it is and How to Calculate it

Furthermore, a higher contribution margin ratio means higher profits. This means that you can reduce your selling price to $12 and still cover your fixed and variable costs. Management uses the contribution margin in several different forms to production and pricing decisions within the business.

The contribution margin may also be expressed as a percentage of sales. When the contribution margin is expressed as a percentage of sales, it is called the contribution margin ratio or profit-volume ratio (P/V ratio). Knowing how to calculate contribution margin allows us to move on to calculating the contribution margin ratio.

As production levels increase, so do variable costs and vise versa. Fixed costs stay the same no matter what the level of production. To calculate contribution margin, a company can use total revenues that include service revenue when all variable costs are considered.

Assume that League Recreation, Inc, a sports equipment manufacturing company, has total annual sales and service revenue of $2,680,000 for all of its sports products. Direct materials are often typical variable costs, because you normally use more direct materials when you produce more items. In our example, if the students sold 100 shirts, assuming an individual variable cost per shirt of $10, the total variable costs would be $1,000 (100 × $10).

Write a Comment